child tax credit 2021 october

As part of the. That depends on your household income and family size.

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

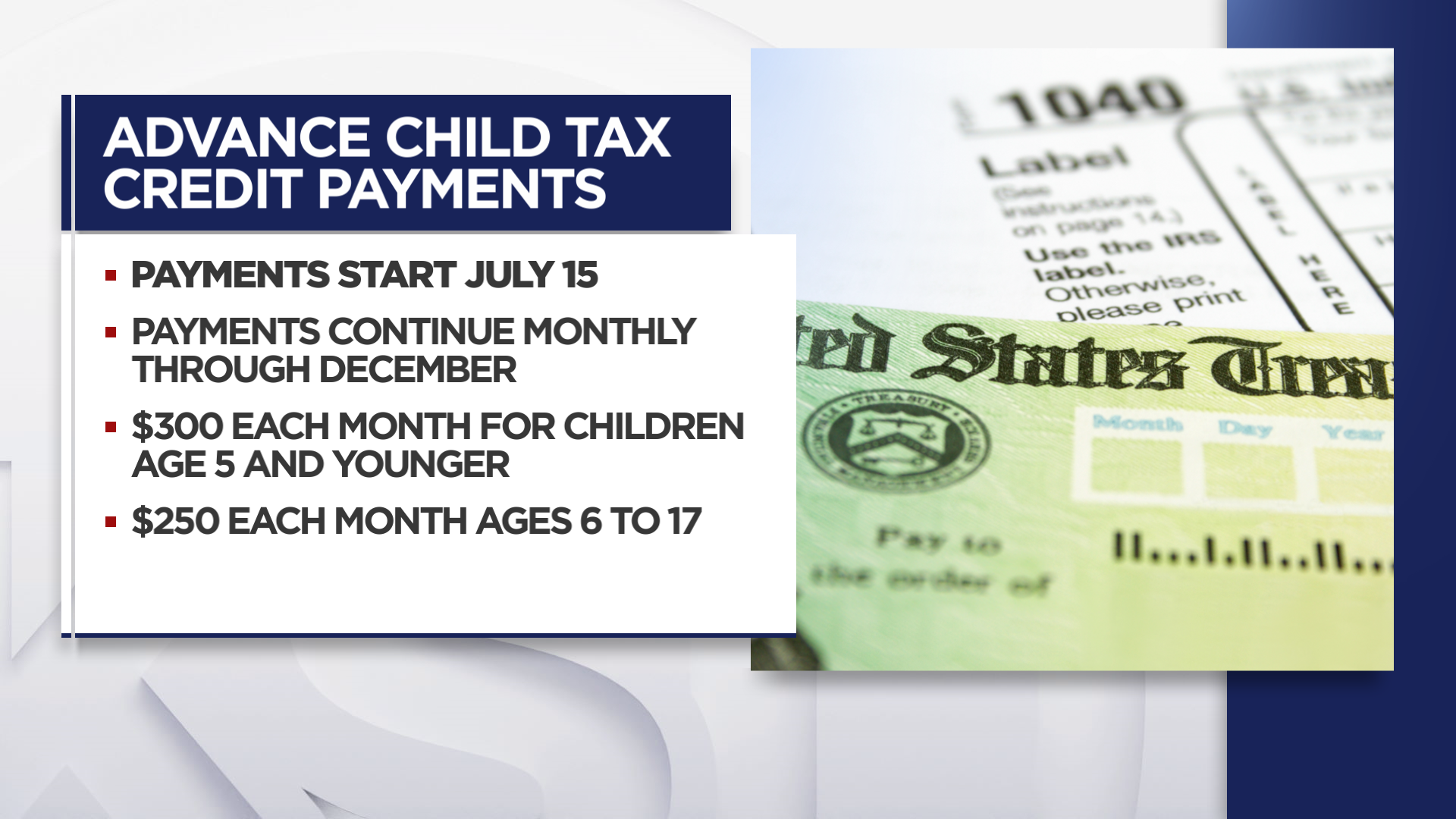

. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child. We explain the key deadlines for child tax credit in October. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days.

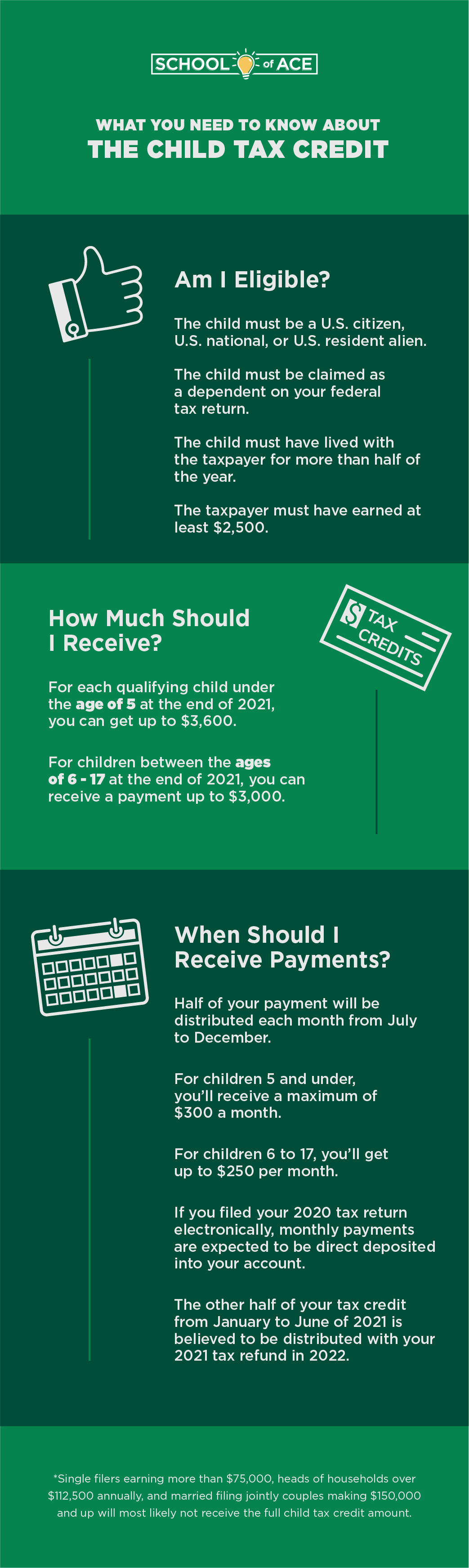

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and. The age limit was also. The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US.

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the. All eligible families could receive the full credit if. Change language content.

Reverts back to up to 2000 for 2022 2025. The Child Tax Credit underwent a significant change in 2021. Here is everything you need to know about the child tax credit and other.

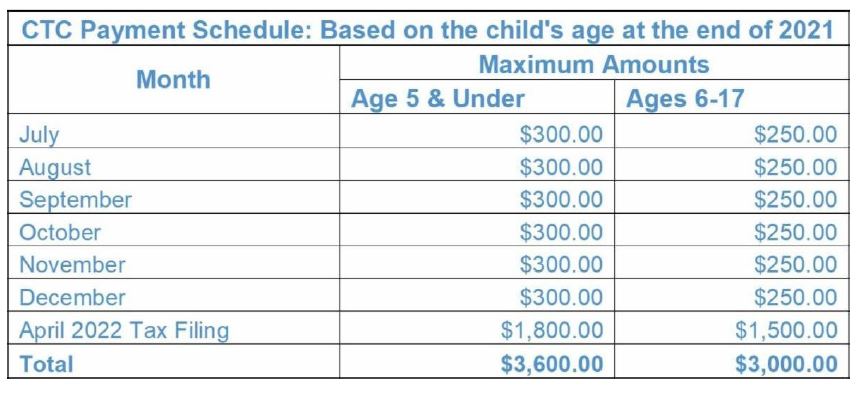

The credit enabled most working families to. 1052 AM PDT October 15 2021. Generally this is 1800 per younger child and 1500 per older child the nonprofit explains.

816 AM CDT October 16 2021. The ARPA increased the CTC from 2000 to 3000 per child for children between 6 years and 17 years and 2000 to 3600 for children below 6 years. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021.

For tax year 2022 the Child Tax Credit reverts back to the benefits available prior to the American Rescue Plan as follows. The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6.

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the. Child tax credit ever. That means another payment is coming in about a week on Oct.

The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. Those who did not receive monthly payments in 2021 can file a tax return to get their. The existing credit of 2000 per child under age 17 was increased to 3600 per.

The child tax credit was temporarily expanded through the American Rescue Plan Act in 2021. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of.

The Child Tax Credit reached 611 million children in. CTC Update 2023 is one of the most anticipated announcements by many families in the United States. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17.

The IRS has confirmed that theyll soon allow. In 2020 and earlier years it was a credit of up to 2000 per child and was claimed on your tax return. 152 PM EDT October 15 2021.

Families Can Now Register For Child Tax Credit Payments

What You Need To Know About The Child Tax Credit

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How To Get Up To 3 600 Child Tax Credit Now Michael Ryan Money

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

October S Monthly Cash Payment For Parents Is Being Sent Tomorrow Here S What You Should Know

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

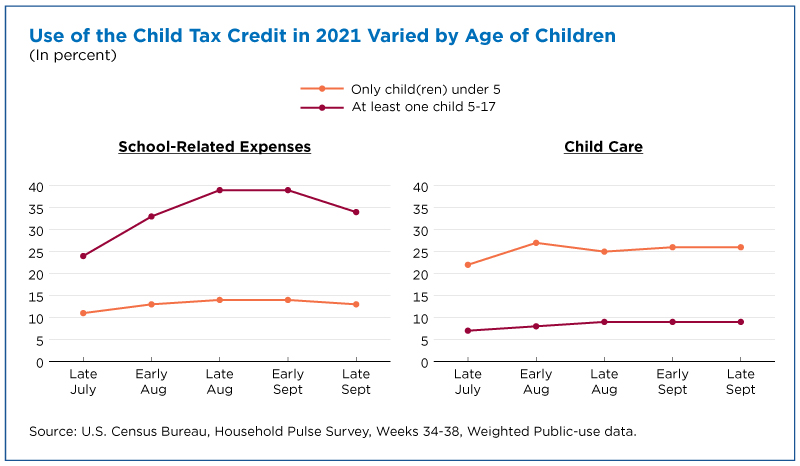

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

What Families Need To Know About The Ctc In 2022 Clasp

What Build Back Better Means For Families In Every State Third Way

2021 Child Tax Credit Advanced Payment Option Tas

Saverlife On Twitter Here At Saverlife We Ve Seen How Much The Advanced Childtaxcredit Payments Have Made A Difference For Families Investing In Families Investing In The Future That S Why We Re

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Advance Child Tax Credit Update October 11 2021 Youtube

Child Tax Credit Schedule How Many More Payments Are To Come Marca

Child Tax Credit December 2021 How To Track Your Payment Marca

How To Get The Child Tax Credit Massachusetts Jobs With Justice